Banking. So many choices to choose from. Do you go with a private bank or credit union? Or do you go with one of the big players with locations all over the country? Now, there are even online banks. How do you know where to go? More importantly, how do they all differentiate themselves?

If you’ve been online at any point over the last 5 years, I’m sure you’ve been targeted with ads for a bank or credit union. I mean, according to Statista, there are over 5,400 credit unions in the United States, and around 74,000 branches of FDIC-insured commercial banks. (ALERT… GREAT Prospecting Opportunity). I’m sure one of those banks/credit unions has targeted you with and ad. And, if not, then there’s a perfect opportunity to reach out to them and see who’s handling their digital.

Before you do though, you should have an idea as to what products work well for Financial Institutions like banks and credit unions.

There are 3 products that we’ve seen work the best (and most frequently used) over the last couple of years. They are:

- Video Pre-Roll Ads

- Native Ads

- Social Mirror Ads

We’ll walk you through each of these products, the strategies to use, and why they work for this industry.

Video Pre-Roll Ads

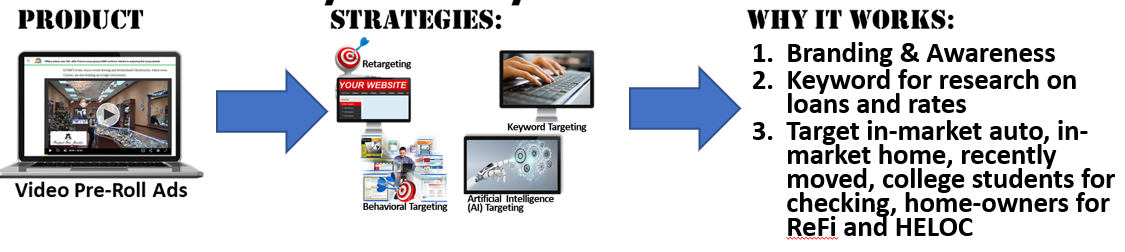

Video Pre-Roll are the ads that you see before the content you are cosuming. For example, if I am on ESPN.com and I click a video to see last night’s game highlights, a video pre-roll ad is going to run before I can watch the highlight video. Video Pre-Roll ads are :15 or :30 in length and can be done with behavioral targeting, keyword targeting, artificial intelligence, and retargeting, and can run across all devices. These ads can be skippable or un-skippable, but that isn’t something that the advertiser is able to dictate, as that is determined by the website in which they are appearing. Un-skippable ads aid in branding and awareness, and with skippable ads, research shows that people who have the option to skip but don’t, are the consumer who are really interested in your product or service. So, it makes sense to have your message delivered both ways.

There are four strategies for Video Pre-Roll Ads.

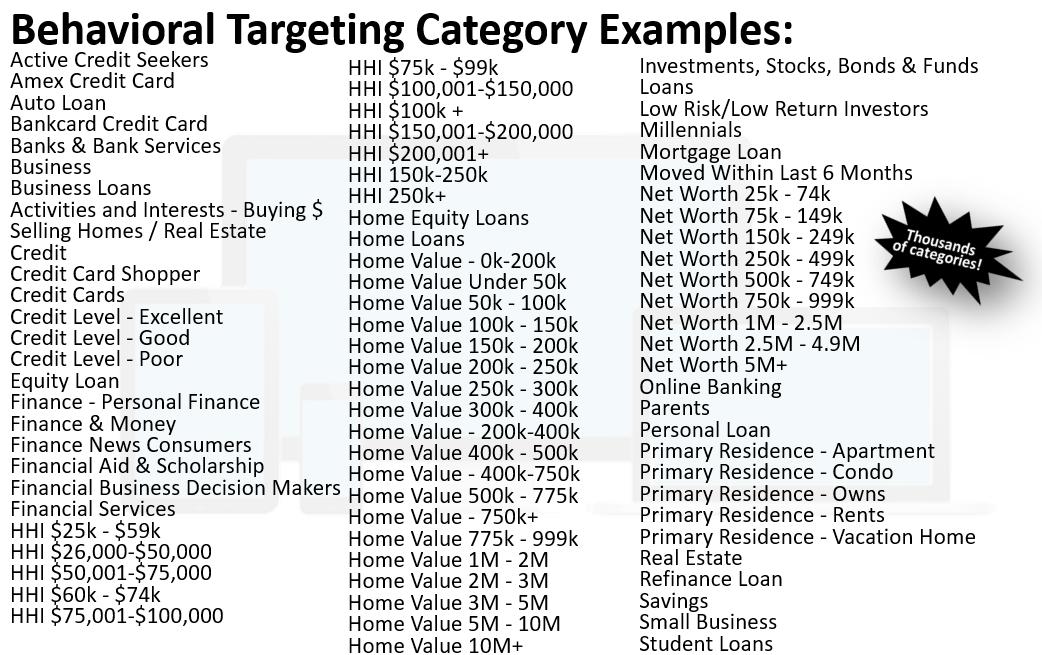

With Behavioral Targeting, we are targeting people based on previous online behaviors and what they’ve shown an interest in, and Ads run on all devices. Since, as consumers, we leave breadcrumbs of data about our behaviors online which are compiled into Behavioral Categories, companies can pick and choose which Behavioral Categories they want to target. For Banks and Credit Unions, here are some of the categories that could be used for a digital campaign:

Artificial Intelligence is going to use machine learning to target customers based on who is engaging with the ad, across all devices. Think of AI Targeting as a funnel, the targeting starts wide and gets narrower as the machine learning algorithm gets more data about who/what is causing clicks and conversions. The machine learning technology is looking at our overall pacing to make sure we hit our impressions goals and optimizing towards when users are online and engaging. The system optimizes based on the internet traffic patterns of users for when they are online and engaging. Looking at device type, browser, what website or app, creative, audience behaviors, how frequently the user has been served impressions, how recently the user has been served impressions.

Retargeting is where we follow people after they leave your website and showing them your 15 or 30-second video pre-roll ad, on other websites and apps they go to, across all devices. Since only 2% of traffic converts the first time they come to a website, having Retargeting included in your campaign aids in the frequency of seeing your ad.

Keyword Targeting is showing your 15 or 30-second video pre-roll ads on webpages and apps that contain keywords related to your business, across all devices. Most keyword lists size are around 75-100, but you can utilize up to 500 keywords within a campaign.

Let’s talk about why Video Pre-Roll Ads work.

- Branding and Awareness – Video is on fire on the internet and consumers can’t get enough of it. Using video in your marketing campaign allows you to have the visual (and audio) messaging that you want your potential customers to see (and hear).

- Keyword for research on loans and rates – As consumers, we all want what we want, when we want it, for the price that we want it for. When it comes to banks and credit unions, they are all competing against each other to earn business for loans, mortgages and more. Using Keyword Targeting allows you to specifically have your ad served to consumers researching loans, mortgages, and other products.

- Targetability – Being able to target people that are currently in-market for a car or new home, people that have recently moved, college students looking for checking accounts, or even people looking to refinance their home has proven to be a great tool.

Native Ads

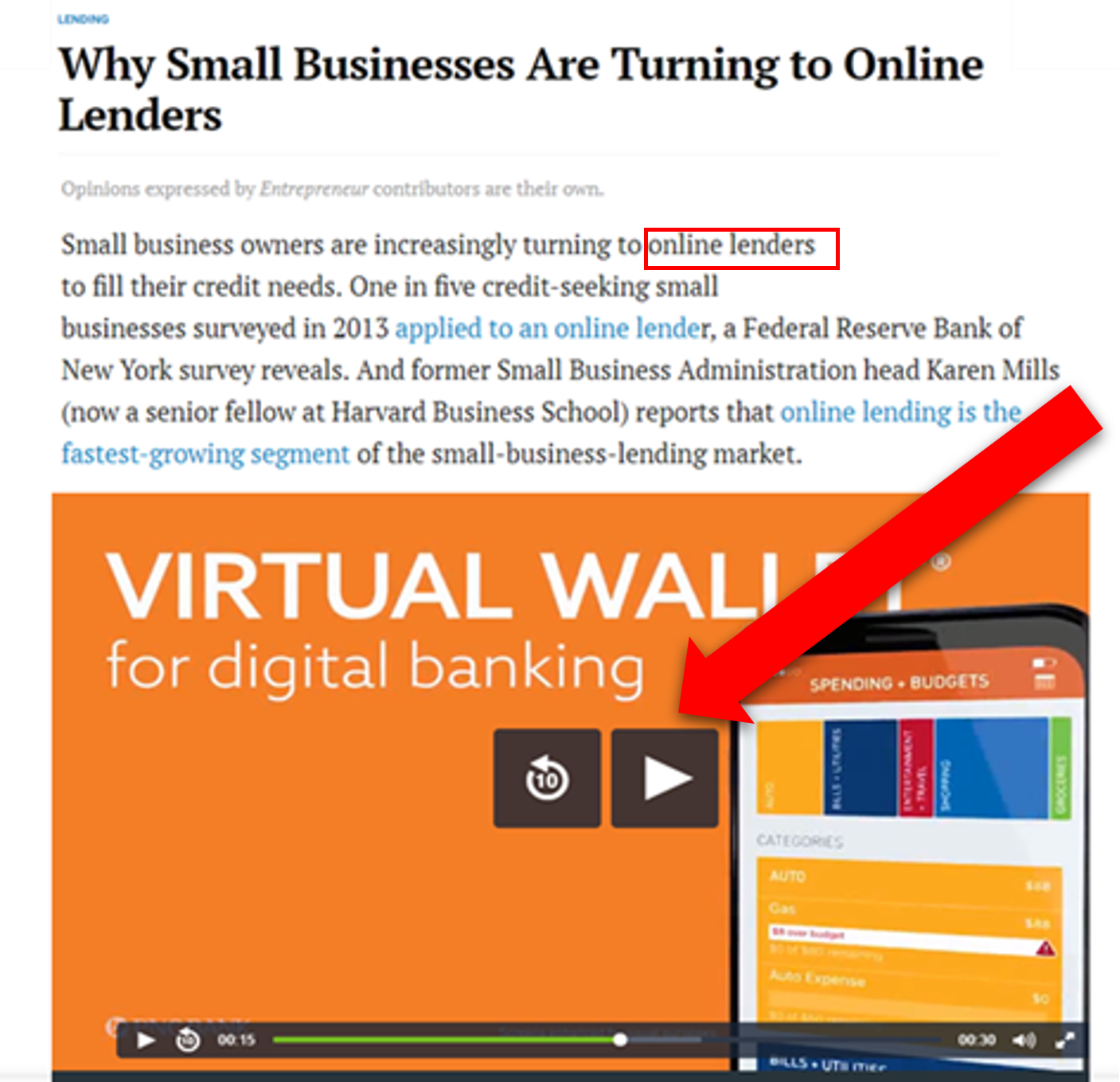

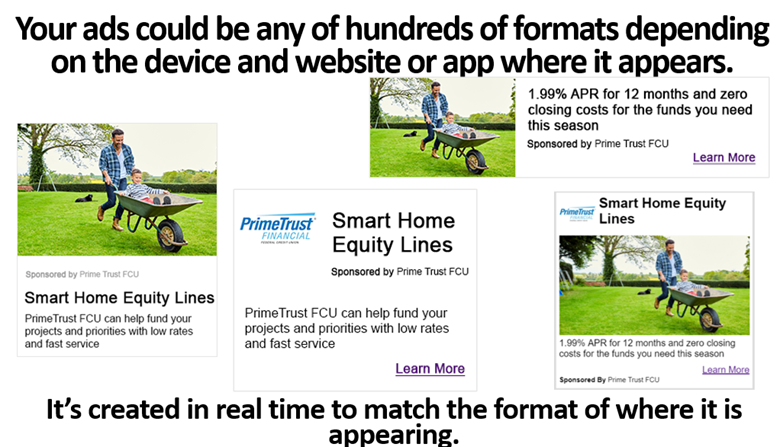

Native, whether you’re using video or display ads, go across all devices and they match the look, feel, and context of the website. Here’s an example as to how ads could vary to match the site/app that they are served on.

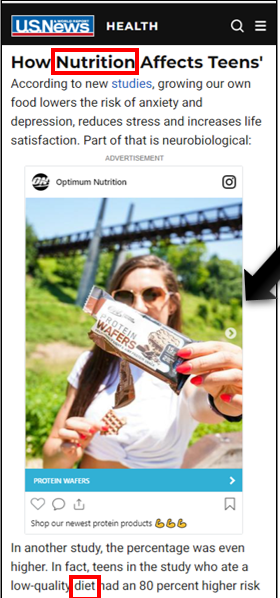

Native Ads are effective because people are reading these ads since they are imbedded into the content on the website or app that they are viewing. Reading the ads requires BOTH hemispheres of the brain, resulting in higher engagement, recall and influence.

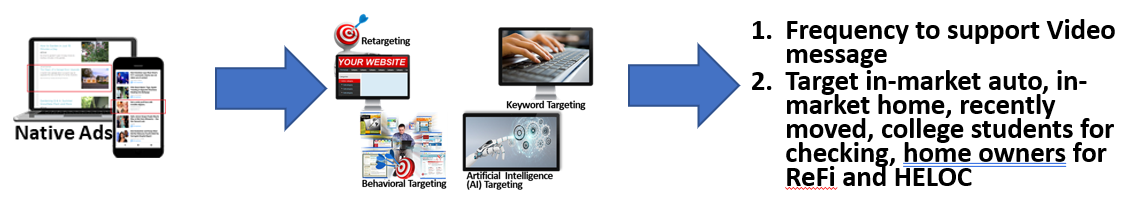

When it comes to targeting strategies for Native Ads (both Display and Video), they utilize the same exact strategies as Video Pre-Roll Ads. These are the 4 again:

Why they work

- Video can be somewhat expensive at times, so using Native to support the frequency of the message can be cost effective.

- Targetability – You can target people that are currently in-market for a car or new home, people that have recently moved, college students looking for checking accounts, or even people looking to refinance their home has proven to be a great tool.

Social Mirror ads look like your social media display or video posts but appear on other websites and apps and run across all devices using our targeting strategies. Social Mirror ads mimic the look and feel of top social media platforms however, the ads appear not on the social platforms, but on thousands of other websites and apps and run across all devices. Each ad links back to the social platform it is mirroring and, has a second call to action button that links to the advertiser’s website! Ads contain unique social actions related back to the originating platform (for example, the like icon, the heart icon, the pinning icon, the retweet icon… those actions are available). These ads can integrate with all the major social media platforms: Facebook, Instagram, Twitter, Linked In, Pinterest, TikTok, Snapchat, and YouTube. Ads can run as display, video or carousel.

When it comes to targeting strategies for Social Mirror Ads, they utilize the same exact strategies as Video Pre-Roll Ads and Native Ads. These are the 4 again:

Why they work

- This is an opportunity for this vertical (banks and credit unions), that likes using Social Media, to be able to promote freely without the limitations that Facebook and Instagram can have.

- Utilizing a carousel ad in the post they are mirroring allows them to promote different lines/offerings (i.e. checking, savings, secured credit cards, etc)

- Banks and Credit Unions can mirror LinkedIn posts to target specifically for the commercial side of their business and utilize some of the other available platforms for residential/consumer lines.

There are many products that can be used to promote most industries, and Banks and Credit Unions are no different. However, from the data that we’ve seen, the best starting points of conversation would lie within Video Pre-Roll Ads, Native Ads (both Display and Video), and Social Mirror Ads.